Market Outlook

March 25, 2019

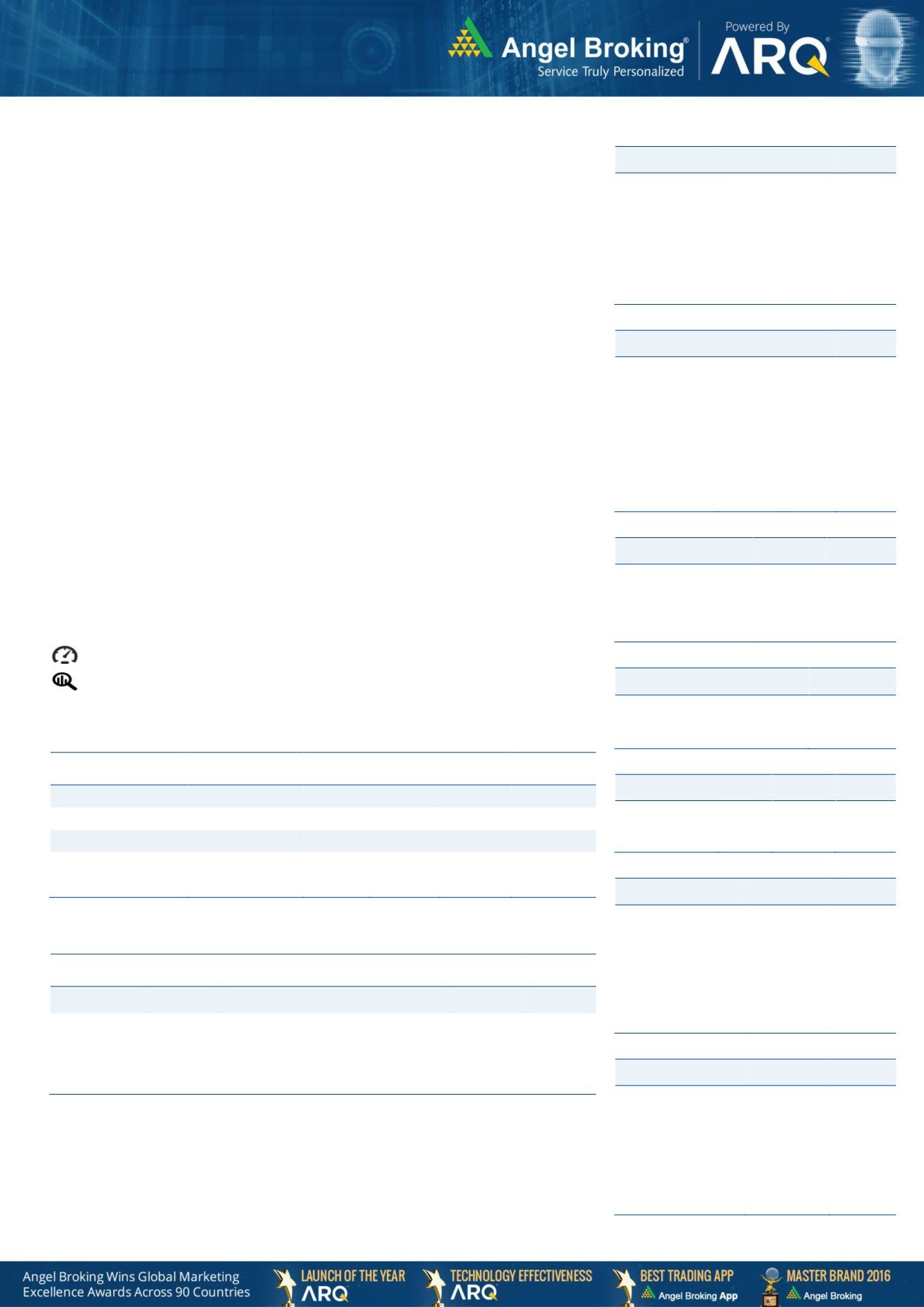

Domestic Indices

Chg (%)

(Pts)

(Close)

Market Cues

BSE Sensex

(0.6)

(223)

38,164

Indian markets are likely to open negative tracking global indices and SGX Nifty.

Nifty

(0.6)

(64)

11,456

US Stocks moved sharply lower over the course of the trading session on Friday,

Mid Cap

(0.6)

(89)

15,076

more than offsetting the rally seen in the previous session. The Nasdaq and the S&P

Small Cap

(0.4)

(66)

14,758

500 pulled back well off Thursday's five-month closing highs. The Dow tumbled 1.8

Bankex

(0.8)

(250)

33,150

percent to 25,502 and the Nasdaq plummeted 2.5 percent to 7,642.

U.K. Market fell notably on Friday as the British pound rebounded on news of a

Global Indices

Chg (%)

(Pts)

(Close)

Brexit extension agreed by the EU. The FTSE 100 was down by 0.7% to 7,307.

Dow Jones

(1.8)

(460)

25,502

On domestic front, Indian shares closed lower on Friday as worries over economic

Nasdaq

(2.5)

(197)

7,642

growth and trade uncertainty prompted traders to book some profits after recent

FTSE

(0.7)

(48)

7,307

string of gains. The benchmark BSE Sensex was ended down by 0.6% to 38,164 at

Nikkei

(3.3)

(698)

20,929

the end of trading session.

Hang Seng

(1.6)

(450)

28,662

Shanghai Com

(0.6)

(19)

3,085

News Analysis

Automobile production, domestic sales decline marginally in February

Advances / Declines

BSE

NSE

1,195

768

Advances

Detailed analysis on Pg2

1,495

1,062

Declines

Investor’s Ready Reckoner

170

107

Unchanged

Key Domestic & Global Indicators

Stock Watch: Latest investment recommendations on 150+ stocks

Volumes (` Cr)

Refer Pg5 onwards

BSE

3,171

NSE

47,548

Top Picks

CMP

Target

Upside

Company

Sector

Rating

(`)

(`)

(%)

Net Inflows (` Cr)

Net

Mtd

Ytd

Blue Star

Capital Goods

Buy

673

867

28.9

FII

(895)

822

(199)

ICICI Bank

Financials

Buy

392

460

17.5

Parag Milk Foods

Others

Buy

256

330

29.0

*MFs

(518)

5,097

6,274

Bata India

Others

Accumulate

1,360

1,479

8.7

KEI Industries

Capital Goods

Buy

403

486

20.6

Top Gainers

Price (`)

Chg (%)

More Top Picks on Pg4

6

9.9

Key Upcoming Events

99

7.1

Previous

Consensus

Date

Region

Event Description

269

6.4

ReadingExpectations

200

4.5

Mar 16, 2019

TU Central Bank Inflation Report

844

4.1

Mar 17, 2019

TH Exports YoY

0.06

--

Mar 17, 2019

TH Exports

$22380m

--

Mar 20, 2019

TH Imports YoY

0.24

--

Top Losers

Price (`)

Chg (%)

Mar 20, 2019

TH Imports

$21776m

--

More Events on Pg7

146

-9.3

333

-5.6

90

-5.4

635

-5.1

33

-4.9

As on Mar 22, 2019

Market Outlook

March 25, 2019

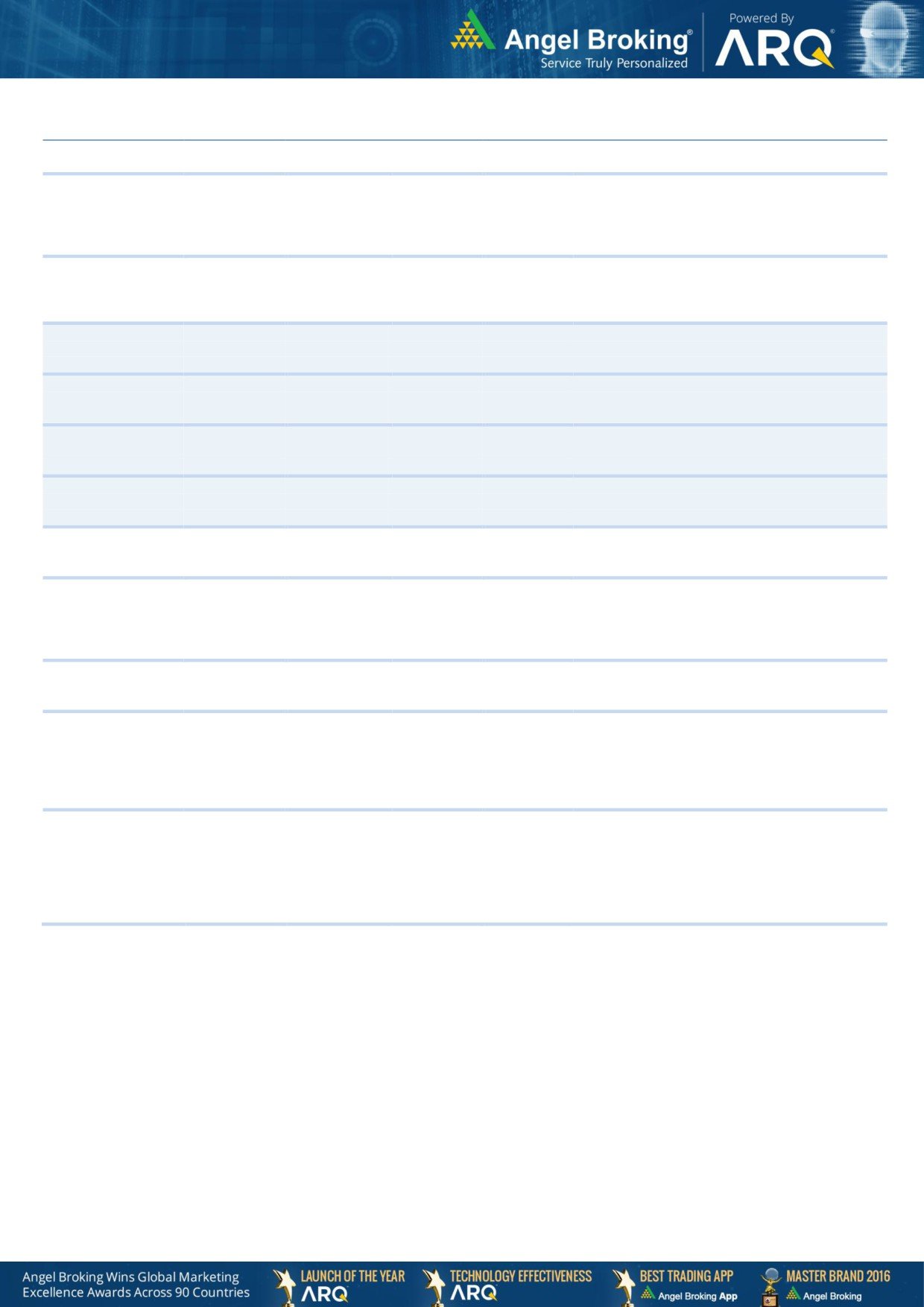

News Analysis

Automobile production, domestic sales decline marginally in

February

Production of automobiles, excluding commercial vehicles and three wheelers, has

seen a marginal decline of 2.2 per cent to 2.27 million units during February

compared to 2.32 million during the same month of last year. While sales during

the month also saw a decline of 3.6 per cent to 1.89 million units in February this

year compared to 1.96 million units in the same month a year ago, cumulative

production and sales during April to February of 2018-19 has seen a growth

compared to the same period last year. During the 11 months ended February 28,

2019, total passenger vehicle production grew 7.7 per cent to 26.6 million units

compared to 24.7 million units during the same period of the previous financial

year.

Cumulative domestic sales also saw a growth of 6.5 per cent to 22.8 million units

compared to 21.4 million units in the corresponding period last year, according to

latest data from Society of Indian Automobile Manufacturers (Siam), the apex body

representing all major vehicle and vehicular engine manufacturers in India.

Growth in sales during the 11 months was evident, though marginally, across

passenger cars, utility vehicles, scooter and motorcycle segments and the mopeds

segment in the domestic market. However, on a year-on-year monthly volume,

domestic sales declined marginally in passenger cars (from 179,122 units in

February 2018 to 171,372 units in February 2019), scooters and scooterettes

(560,653 to 492,584) and motorcycles (1.05 million to 1.04 million) while

volumes increased in utility vehicles (80,271 to 83,245 units) and mopeds (71,931

to 75,001 units) during the period.

Economic and Political News

Domestic coastal shipping sees more competition, rise in tonnage

Centre to save Rs 10,600 crore on PM-Kisan scheme this fiscal year

Sebi seeks more powers to inspect books of listed firms, thwart frauds

PM-Kisan: About 4.74 cr farmers to get second installment from next month

Govt crosses divestment target for 2nd year in a row; rakes in Rs 85,000 cr

Corporate News

Uber could seal $3 bn deal to buy Dubai rival Careem this week

Logistics firm Delhivery turns unicorn as SoftBank couriers $413 million

Rs 3 trn-worth investment in pvt power plants at risk of turning into NPA

Shell out up to Rs 25,000 more for Tata Motors cars from April 1

DCM Shriram to raise $35 mn from IFC to support $86 mn capex plan

L&T expects Mindtree investment to generate above-average returns

Market Outlook

March 25, 2019

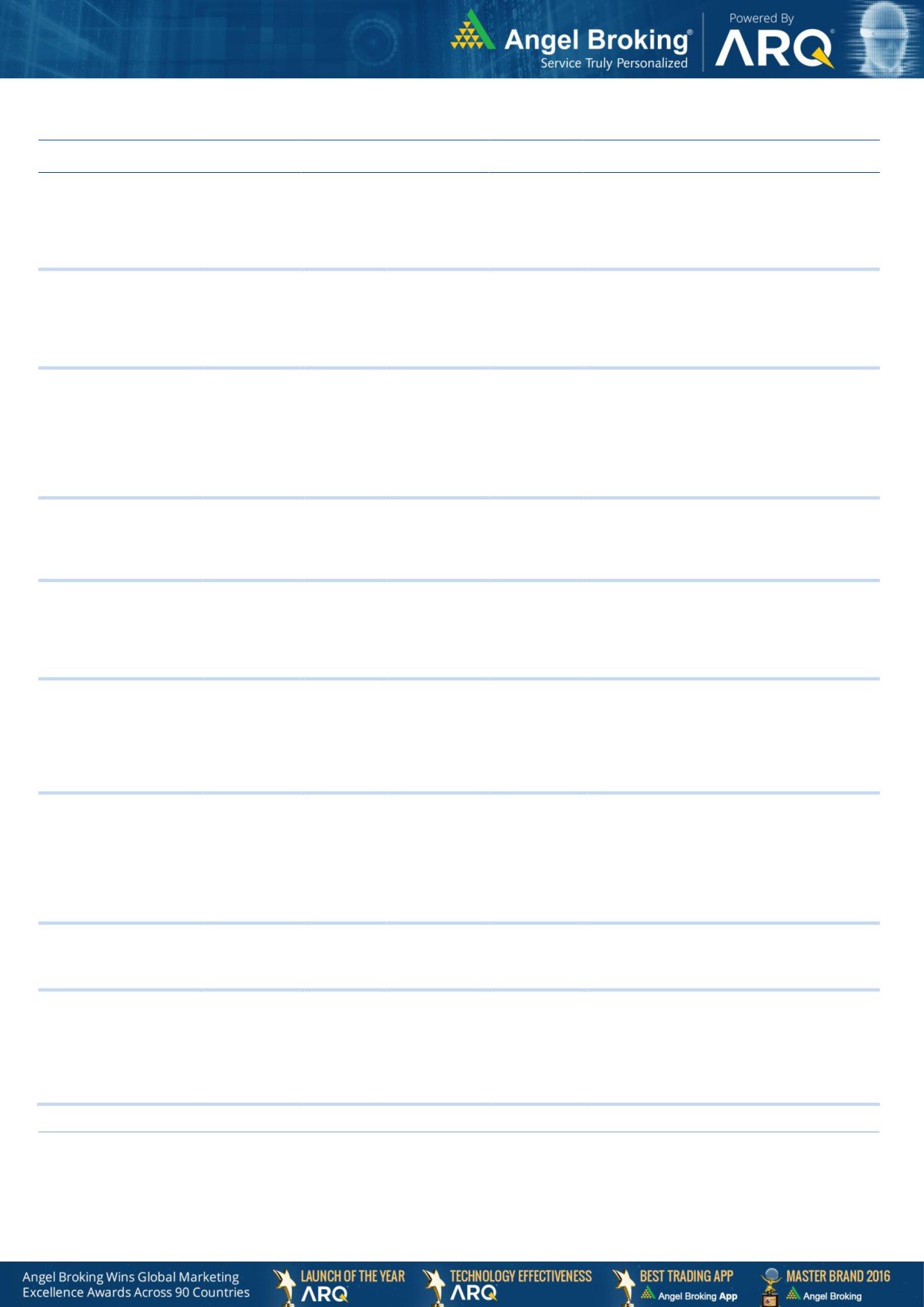

Top Picks

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

Favorable outlook for the AC industry to augur well

for Cooling products business which is out pacing

Blue Star

6,478

673

867

28.9

the market growth. EMPPAC division's profitability

to improve once operating environment turns

around.

Well capitalized with CAR of 18.1% which gives

sufficient room to grow asset base. Faster

ICICI Bank

2,52,395

392

460

17.5

resolution of NPA would reduce provision cost,

which would help to report better ROE.

High order book execution in EPC segment, rising

KEI Industries

3,181

403

486

20.6

B2C sales and higher exports to boost the revenues

and profitability

Expected to benefit from the lower capex

Music Broadcast Limited

1,704

60

95

57.4

requirement and 15 year long radio broadcast

licensing.

Strong brands and distribution network would

Siyaram Silk Mills

1,922

410

606

47.8

boost growth going ahead. Stock currently trades

at an inexpensive valuation.

GST regime and the Gujarat plant are expected to

Maruti Suzuki

1,98,104

6,558

10,820

65.0

improve the company’s sales volume and margins,

respectively.

We expect loan book to grow at 24.3% over next

GIC Housing

1,369

254

424

66.8

two year; change in borrowing mix will help in NIM

improvement

Third largest brand play in luggage segment

Increased product offerings and improving

Safari Industries

1,632

731

1,000

36.8

distribution network is leading to strong growth in

business. Likely to post robust growth for next 3-4

years

We expect financialisation of savings and

Aditya Birla Capital

22,575

103

151

47.2

increasing penetration in Insurance & Mutual fund

would ensure steady growth.

One of the leading Indian dairy products

companies in India created strong brands in dairy

products. Rising revenue share of high-margin

Parag Milk Foods

2,151

256

330

29.0

Value Added Products and reduction in interest cost

is likely to boost margins and earnings in next few

years.

HDFC Bank maintained its steady growth in the

4QFY18. The bank’s net profit grew by 20.3%.

Steady growth in interest income and other income

HDFC Bank

6,19,511

2,275

2,500

9.9

aided PAT growth. The Strong liability franchise

and healthy capitalisation provides strong earning

visibility. At the current market price, the bank is

trading at 3.2x FY20E ABV.

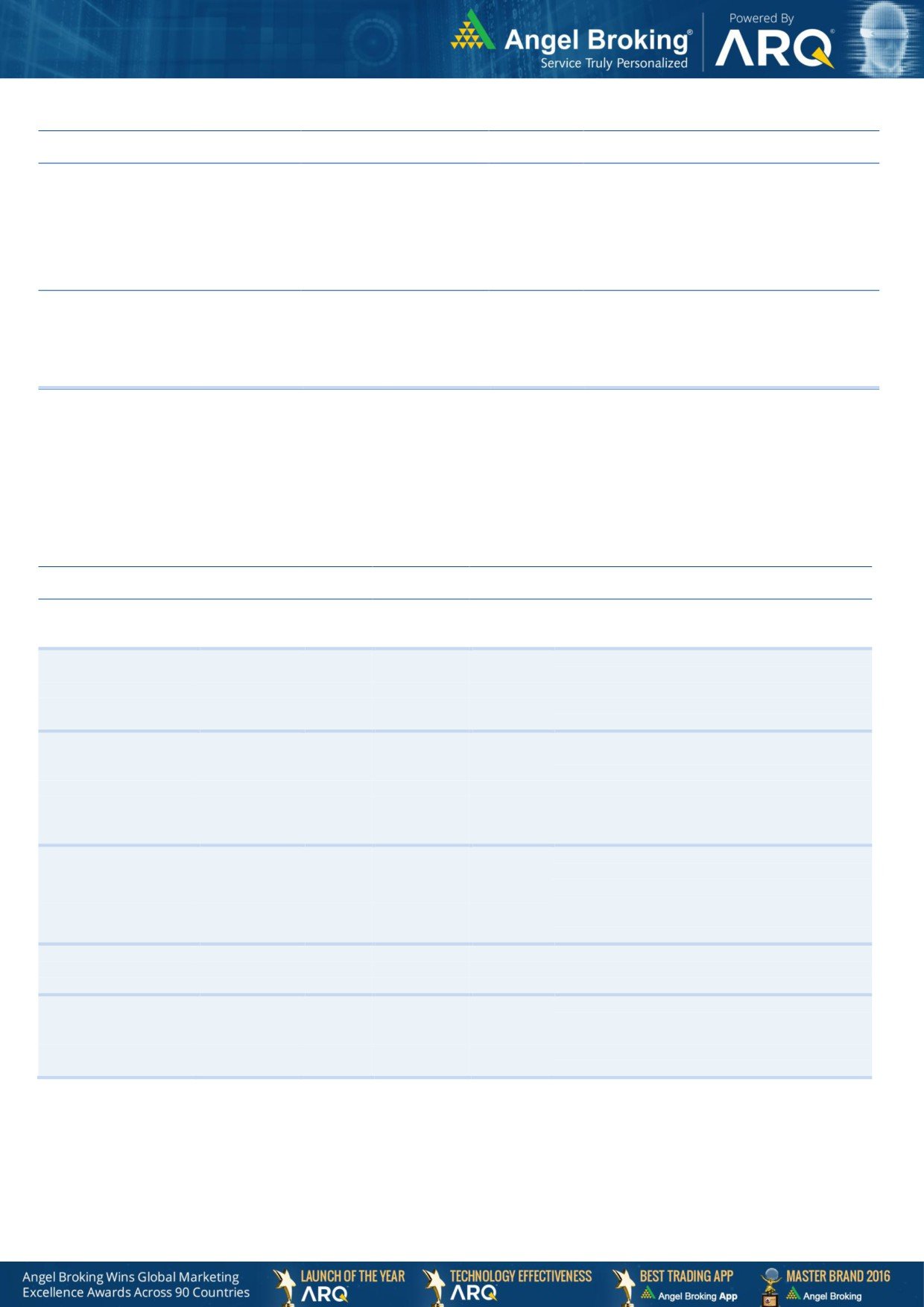

Market Outlook

March 25, 2019

Continued...

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

We expect strong PAT growth on back of

healthy growth in automobile segment (on back

of new launches and facelifts in some of the

M&M

84,369

679

1,050

54.7

model ) and strong growth in Tractors segment

coupled by its strong brand recall and

improvement in rural sentiment

Market leader in the room air conditioner (RAC)

outsourced manufacturing space in India with a

market share of

55.4%. It is a one-stop

Amber Enterprises

2,475

787

984

25.0

solutions provider for the major brands in the

RAC industry and currently serves eight out of

the 10 top RAC brands in India

BIL is the largest footwear retailer in India,

offering footwear, accessories and bags across

brands. We expect BIL to report net PAT CAGR

of

~16% to

~`3115cr over FY2018-20E

Bata India

17,484

1,360

1,479

8.7

mainly due to new product launches, higher

number of stores addition and focus on

women’s high growth segment and margin

improvement

SHTF is in the sweet spot with benefits from

stronger CV volumes, NIMs unaffected by rising

Shriram Transport Finance

27,196

1,199

1,764

47.2

bond yields on the back of stronger pricing

power and an enhancing ROE by 750bps over

FY18-20E, supported by decline in credit cost.

We expect JSPL’s top line to grow at 27% CAGR

over FY19-FY20 on the back of strong steel

demand and capacity addition. On the bottom

Jindal Steel & Power Limited

16,097

166

327

96.6

line front, we expect JSPL to turn in to profit by

FY19 on back of strong operating margin

improvement.

GMM Pfaudler Limited (GMM) is the Indian

market leader in glass-lined (GL) steel

equipment. GMM is expected to cross CAGR

GMM Pfaudler Ltd

1,730

1,184

1,400

18.3

15%+ in revenue over the next few years

mainly led by uptick in demand from user

industries and it is also expecting to increase its

share of non-GL business to 50% by 2020.

Aurobindo Pharmaceuticals, amongst the

Indian Pharmaceutical companies, is well

placed to face the challenging generic markets,

given its focus on achieving growth through

Aurobindo Pharmaceuticals

45,065

769

890

15.7

productivity. Aurobindo will report net revenue

& net profit CAGR of ~13% & ~8% resp.

during FY2018-20E. Valuations are cheap V/s

its peers and own fair multiples of 17-18x.

We believe advance to grow at a healthy CAGR

of 35% over FY18-20E. Below peers level ROA

RBL Bank

27,188

638

690

8.2

(1.2% FY18) to expand led by margin

expansion and lower credit cost.

TTK Prestige has emerged as one of the leading

brands in kitchen appliances in India after its

successful transformation from a single product

TTK Prestige

8,994

7,786

9,250

18.8

company to offering an entire gamut of home

and kitchen appliances. We are expecting a

CAGR of 18% in revenue and 25% in PAT over

FY2018-20.

Maintain Hold.

Source: Company, Angel Research

Market Outlook

March 25, 2019

Continued...

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

We expect Inox Wind to report exponential

growth in top-line and bottom-line over FY19-

20E. The growth would be led by changing

renewable energy industry dynamics in favor of

Inox Winds

1,538

69

120

73.2

wind energy segment viz. changes in auction

regime from Feed-In-Tariff (FIT) to reverse

auction regime and Government’s guidance for

10GW auction in FY19 and FY20 each.

Considering the strong CV demand due to

change in BS-VI emission norms (will trigger

pre-buying activities), pick up in construction

Ashok Leyland

26,244

89

156

74.5

activities and no significant impact on industry

due to recent axle load norms, we recommend

BUY on Ashok Leyland at current valuations.

Source: Company, Angel Research

Fundamental Call

Market Cap

CMP

Target

Upside

Company

Rationale

(` Cr)

(`)

(`)

(%)

CCL is likely to maintain the strong growth

CCL Products

3,758

283

360

27.4

trajectory over FY18-20 backed by capacity

expansion and new geographical foray

We forecast Nilkamal to report top-line CAGR of

~9% to `2,635cr over FY17-20E on the back of

Nilkamal

2,112

1,415

2,178

53.9

healthy demand growth in plastic division. On the

bottom-line front, we estimate

~10% CAGR to

`162cr owing to improvement in volumes.

Elantas Beck India is the Indian market leader in

liquid insulation segment used in electrical

equipments like motors, transformers etc. It derives

Elantas Beck India Ltd

1,796

2,265

2,500

10.4

demand from several industries which are expected

to register 10%+ CAGR in demand in the coming

years. We can book out from the stock with 16%

profit at Rs. 2500 TP.

Greenply Industries Ltd (GIL) manufactures plywood

& allied products and medium density fibreboards

(MDF). GIL to report net revenue CAGR of ~14% to

Greenply Industries

1,894

154

256

65.7

~`2,478cr over FY2017-20E mainly due to healthy

growth in plywood & lamination business on the

back of strong brand and distribution network

L&T Fin’s new management is on track to achieve

L&T Finance Holding

29,173

146

210

43.9

ROE of 18% by 2020 and recent capital infusion of

`3000cr would support advance growth.

Well planned strategy to grow small business loans

and cross-selling would propel fees income. We

Yes Bank

58,455

253

290

14.9

expect YES to grow its advance much higher than

industry and improvement in asset quality to

support profitability.